Hard Money Loan For New Construction in Somerville, MA.

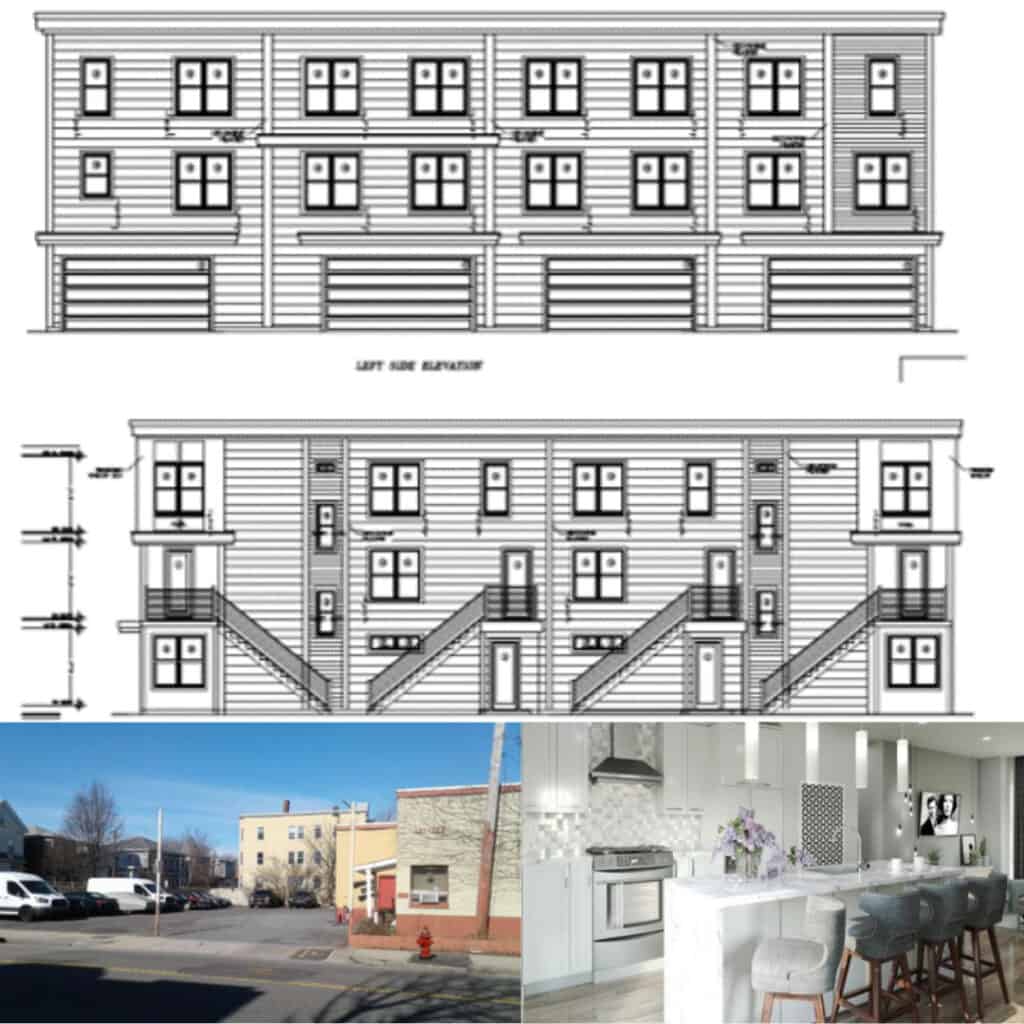

Today’s deal comes from Michael Chadwick, who just closed a new construction loan for 8 luxury townhouse units with a repeat ABL borrower in Somerville MA. The property was purchased for $3,470,000 and had a construction budget of $3,025,000. ABL approved a loan to fund 75% of the land purchase, 100% of construction, and an interest reserve. The result was a total loan of $5,777,000, which was equal to 89% LTC! The appraisal was expedited because we don’t use appraisal management companies, which allowed us to close in as little as 2 weeks.

ABL provided the borrower with a 24-month term which gave them ample time to complete the construction of the eight 3 bed / 2.5 bath, 2,400sf luxury townhouse units. These units will feature high-end finishes throughout including Wolf/Subzero appliances, custom shaker kitchen cabinets and vanities, Brizo plumbing fixtures, and Porcelanosa tiles. The owners will have both off-street parking and garage spaces, which is highly desirable in a market like Somerville. The units are expected to sell out for between $1,500,000 and $1,650,000.

One of the key structural elements to ABL’s construction loan is our attractive partial release provisions. Here at ABL, we treat multi-unit projects like this as a blanket loan, allocating loan balances and values to each unit. We then require that only 120% of the allocated loan amount from the sale of each unit go to pay down the overall loan. This is important because it provides the borrower with flexibility and a return of capital starting with the sale of the very first unit! By comparison, some lenders require 100% of net proceeds from the sale of each unit until they are completely paid off. This can put a strain on the borrower’s liquidity until the last few units sell. ABL’s partial release structure gives us a competitive advantage in this regard, allowing us to routinely win borrower’s business when it comes to multi-unit/multi-property blanket loans.

Brookline is an upper-class suburb outside of Boston that has seen strong growth in its real estate market over the last decade but especially in the last year. As of April 2021, the average home sale price reached $945,000 which is a 14% increase from the year before and represents a five-year-high. 55 homes sold during the month of April, marking a 68% increase in home sales for the area compared to the previous year. Homes are spending an average of 34 days on the market which indicates a hot seller’s market and a strong stat for fix and flip investors and builders looking for their next Massachusetts deal. For comparison, a balanced market sees homes spend an average of 60-90 days on the market. By using ABL hard money loans for new construction to finance their project, Somerville real estate investors can take advantage of the current market conditions.

Somerville is a city located in Middlesex County, Massachusetts, just two miles north of Boston. Occupying slightly over 4 square miles, its population of 81,360 (as of the 2019 census), Somerville is one of the most densely populated communities in New England. The Somerville, MA real estate market has seen an increase in the number of listings by 42.4% between February and March. While the average time on the market in March 2022 was 33 days, the median list price was $923,857. Real estate listing prices changed between February 2022 and March 2022: 1-bedroom properties became 1.8% more cheaper, 2 bedrooms properties prices increased by 7.1%, 3 bedrooms properties became 10.4% more expensive, 4 bedrooms properties prices increased by 9.9%, prices of 5 bedrooms properties increased by 3.3%. Housing inventory has changed in this real estate market: volume of 1-bedroom homes went up by 62.5%, 2-bedroom homes inventory increased by 36.7%, the quantity of 3-bedroom homes went up by 43.3%, 4-bedroom homes inventory increased by 22.7%, and the number of 5-bedroom homes increased by 51.2%. In March 2022 more than 27 listings in Somerville, MA were sold above the asking price. This fast-moving market requires a Somerville hard money lender that can move equally fast so investors can remain competitive, which Asset Based Lending specializes in.

Mike is a proud member of ABL team. “I’m always impressed by the speed and efficiency of our ABL team, but the ability to approve and close loans that are time sensitive can’t be understated. This deal would have never happened,” said Mike. Mike covers the New England markets, bringing two decades of experience and market knowledge to our borrowers in the area. If you’re looking for hard money loans for fix and flips or new construction, or are interested in our term rental loans, then contact Mike today.